1099 4up recipient condensed copies distributions 1099 forms & instructions 2018 edition part 2 (2/8) Form 1099-r

How to Calculate Taxable Amount on a 1099-R for Life Insurance

1099 contract briefly 1099 form retirement distributions pensions annuities etc tax forms 1099 taxable withdrawal calculate calculation ira endowment theinsuranceproblog

Do i need to report a 1099-r

Form 1099-r 4up quadrant distributions from pensions, etc.1099 form 1099r taxes brief filing Rrb 1099 r simplified method worksheet formIndex of /forms.

How-to time: prepping your 1099-miscHow to calculate taxable amount on a 1099-r for life insurance Retirement 1099 rrb form railroad medicare forms index plan rr major medical1099 calculate taxable.

1099 form tax information irs instructions accurate walk forms each let through report they item review

Form 1099-r instructions & information1099-r software: 1099r printing software 1099 forms different typesUnderstanding your 1099-r.

1099 rrb form signnow pdf sign1099 sample forms form printable 1099r sheets software success How to prepare and file a 1099 for contract and freelance workersWhere to enter 1099-rrb information – ultimatetax solution center.

How to calculate taxable amount on a 1099-r for life insurance

1099 w2 form misc tax income employee does federal 1040 contractor forms withheld taxes pay business box prepping time differenceUnderstanding the different types of 1099 forms .

.

Rrb 1099 R Simplified Method Worksheet Form - Fill Out and Sign

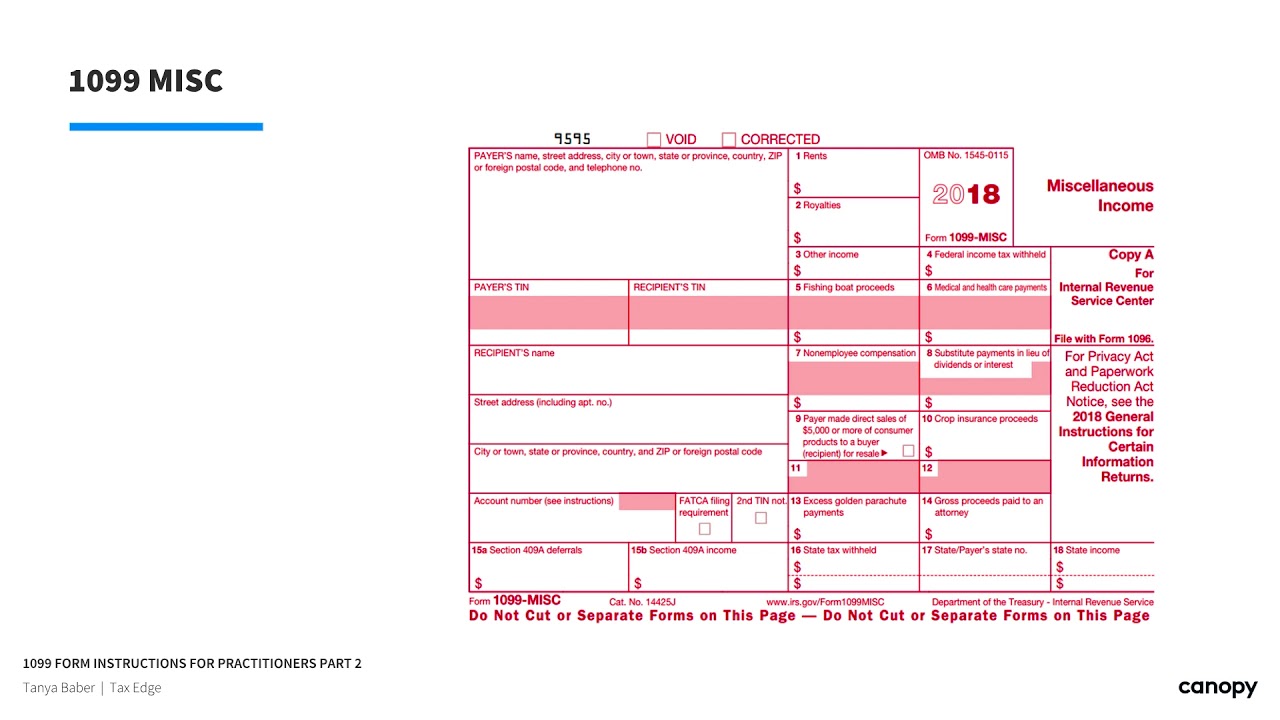

How-To Time: Prepping your 1099-MISC

How to Calculate Taxable Amount on a 1099-R for Life Insurance

1099 Forms & Instructions 2018 Edition Part 2 (2/8) - YouTube

Understanding the Different Types of 1099 Forms

Where to Enter 1099-RRB Information – UltimateTax Solution Center

Understanding Your 1099-R | Dallaserf.org

Form 1099-R - Distributions from Pensions, Annuities, Retirement, etc

How To Prepare And File A 1099 For Contract And Freelance Workers